INTRODUCTION

A MATTER OF URGENCY

There is an urgent need to slow the planet's rising temperature, but is that necessity reflected in the travel management programmes of companies around the world?

By Elizabeth West & Andy Hoskins (published 24 September 2024)

“Doing something is always better than doing nothing,” American Express Global Business Travel sustainability SVP Nora Lovell Marchant told a BTN webinar audience last summer. “The United Nations doesn’t have the power politically to wave a magic wand to say 'these are global carbon standards.' If we are all waiting for something like that to happen, we can kiss the goals of the Paris Agreement goodbye.”

Marchant was referring to the climate change agreement of 2015 in which world leaders pledged to cut their respective countries' greenhouse gas emissions to try to prevent global temperatures rising by more than 1.5 degrees Celsius – the level that climate scientists estimate would be a breaking point above which the planet would sustain irreversible damage.

In lieu of global carbon standards or shared strategies, governments are applying a number of approaches to induce their societies – including industries – to reduce their environmental impact.

The European Union has been aggressive on the regulatory front with its broad-based Corporate Sustainability Reporting Directive (CSRD), rolling out in phases over the next few years, beginning in 2025, to include more and smaller companies as the phases progress. It includes business travel emissions as a single line item, scope 3.6, and employee commuting as another, scope 3.7 – both lifted from the GHG Protocol which set out the world's most widely used greenhouse gas accounting standards.

The US, as well, has taken regulatory action, though it’s been subject to numerous delays. The Securities and Exchange Commission in March adopted rules that standardise climate-related disclosures in reporting by public companies; however, this is currently restricted to scope 1 and 2 emissions. While previous proposals included reporting requirements for scope 3 emissions, the final rule has been criticised for its “watered down” approach.

California has stepped into the gap. The state’s Climate Corporate Data Accountability Act also mandates GHG emissions and climate risk disclosures – including scope 1 and 2 emissions from 2026 and scope 3 from 2027.

Addressing greenhouse gas emissions isn’t all about regulatory requirements; indeed, reporting on emissions data doesn’t necessarily translate into taking action. That said, many companies have pledged to do so, and voluntarily have submitted plans to the Science Based Target initiative (SBTi) regarding the actions they will take to achieve net-zero operations by a certain date.

SETTING TARGETS

More than 60 per cent of respondents to BTN Europe’s survey – conducted in August and September – said their companies have set overall carbon reduction targets, with that figure rising to 70 per cent among European travel managers. Those targets come in different shapes and forms – many will have been publicly declared and some approved by the Science Based Targets initiative (SBTi).

By June this year, SBTi said more than 5,500 companies around the world have had targets validated.

REDUCTION RATIONALE

Among the reasons cited for setting business travel emission reduction goals, three options stood out from the rest: to comply with government regulation, because senior management has stressed its importance, and because respondents’ employers are specifically pursuing a strategy of reducing business travel emissions.

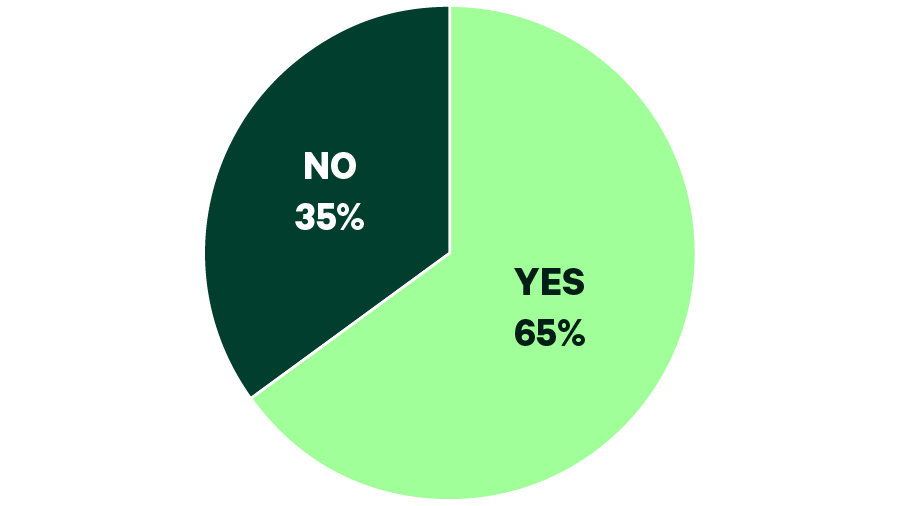

Looking at the regional results, it’s little surprise that complying with government regulation was selected by nearly two-thirds (65 per cent) of European respondents – compared with 41 per cent in the US – with CSRD reporting required of many EU-based companies from 2025.

Lower down the pecking order, only 29 per cent of travel managers said that customers were exerting pressure on them to reduce business travel emissions, and 23 per cent said their emissions reduction targets were also implemented to help attract and retain employees.

According to Deloitte, such companies are positioning themselves well in the fight for talent. The consulting giant’s 2024 Gen Z and Millennial Survey showed 72 per cent of Gen Zs and 71 per cent of Millennials look at environmental credentials and policies when considering a potential employer.

MAKING PROGRESS

Collating and reporting on emissions from business travel activity is the logical place to begin building an emissions reduction strategy, as highlighted by the 59 per cent of travel managers who have been tasked with doing just that.

And it’s the right first step, according to Salesforce EMEA and Latam senior manager of travel and sustainability Jenny Sabineu. But, she says, getting a solid data set from multiple sources and digging into the finer features of the data is what ultimately makes meaningful action possible, and it’s not easy.

“Our real data before structuring a programme was all over the place,” she says, citing booking tools, expense tools, credit cards and suppliers all as emissions data sources that had to be normalised for Salesforce’s proprietary carbon calculations.

Once you have the data, then you have to interrogate it. “You need to run your data. What is it telling you? Where are those opportunities for your company?” she asks. “Just because [a benchmarking partner] is doing something successfully in Chicago does not mean that Salesforce is going to have those same opportunities.”

There was notable regional disparity on the next two actions in the survey, with traveller booking behaviour modifications undertaken by 52 per cent of European respondents but only 37 per cent of North American travel managers.

A considerably larger gulf was identified when it comes to travel managers turning to modal shift as a means of reducing emissions. Nearly two-thirds of European travel managers have or are working on strategies to move business travellers from planes to trains compared to 26 per cent in North America where the infrastructure to do so is limited.

UK-based engineering and management consultancy Mott MacDonald is one such company turning to rail. It has identified carbon-efficient rail options across nearly 20 domestic routes. The policy change requires travellers to book rail on these routes, unless they have specific approval to book air.

Since the modal shift campaign was introduced last July, group travel manger Flo Chick says carbon emissions on the identified routes have dropped by 50 per cent.

Chick said OBT preferencing capabilities will be critical in driving further behaviour change among travellers, such as the ability to sort search results according to carbon emissions rather than by cost.

“Once you've got the tools to do that, you don't have to necessarily write the policy so much as apply the logic in the rules,” she explains.

ADVANCED APPROVALS

Although many companies in BTN Europe’s survey have set emissions reduction goals and implemented a number of strategies to deliver on them, few have tightened up approvals processes as a means of doing so.

Overall, just over a quarter of travel managers said approvals thresholds have been altered as part of their sustainability efforts. However, more than four in ten have done so in Europe compared to two in ten in North America. Another sign, perhaps, that Europe is further along its sustainability journey.

REPORTING COMPLIANCE

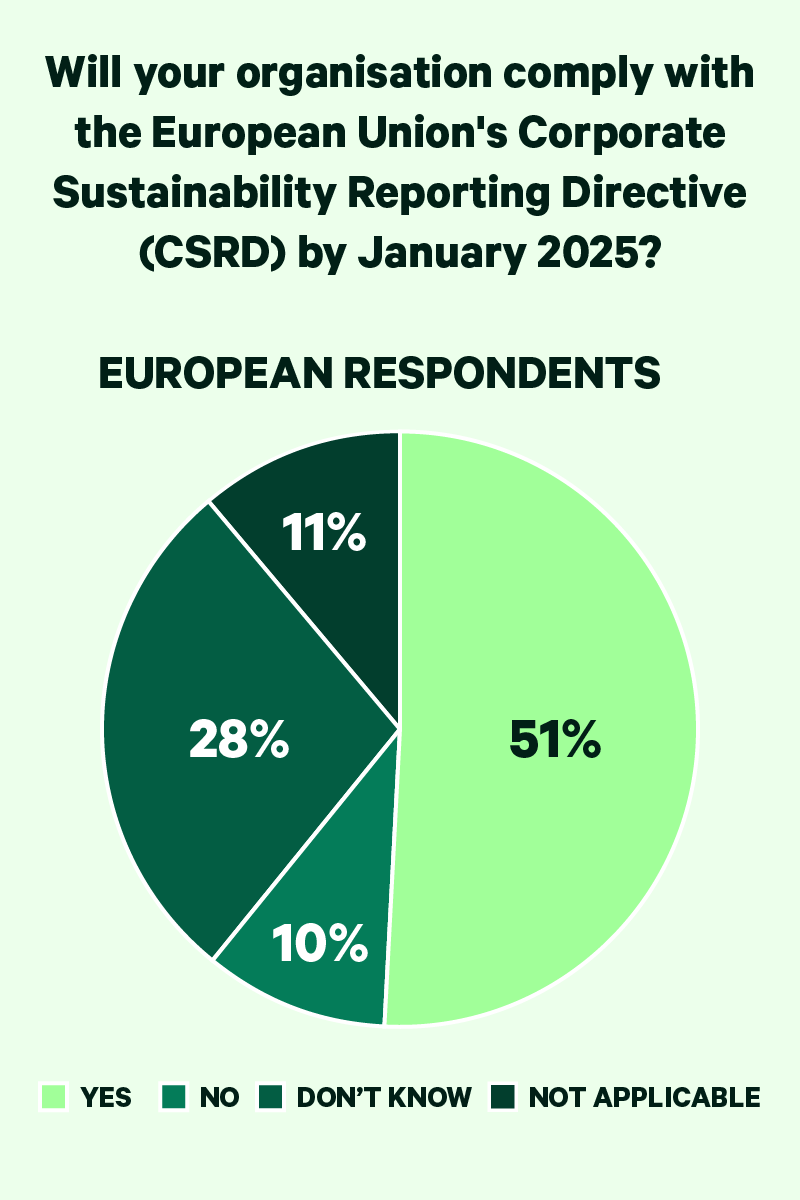

More than half of the European travel managers surveyed said their company would be ready to comply with the European Union’s Corporate Sustainability Reporting Directive by 2025, when certain companies must publicly report their environmental impact, including the emissions associated with their business travel activity (scope 3.6).

Only ten per cent said their company would not be ready and a similar figure said CSRD would not apply to their company. Nearly three in ten travel managers did not know whether their company would be ready to report, perhaps reflecting the fact that sustainability reporting does not always fall under travel managers’ remit.

(90 respondents)

(90 respondents)

NEGATIVE IMPACT

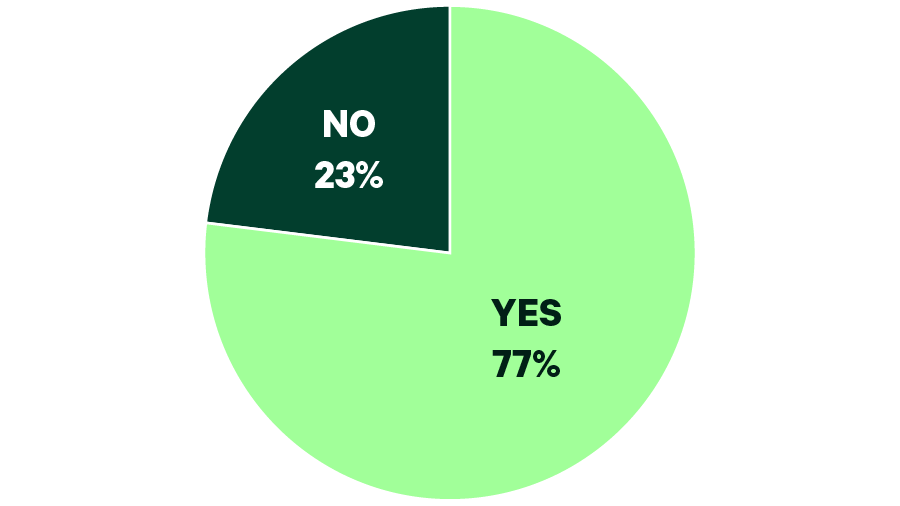

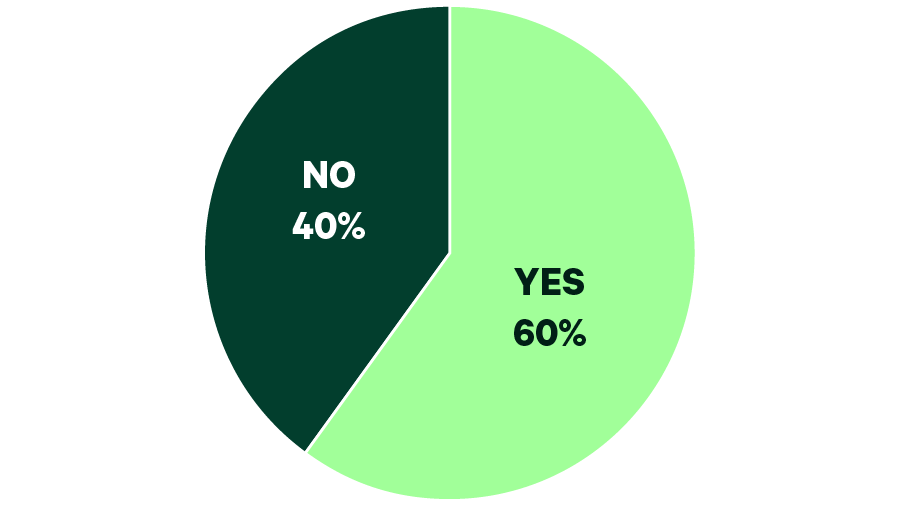

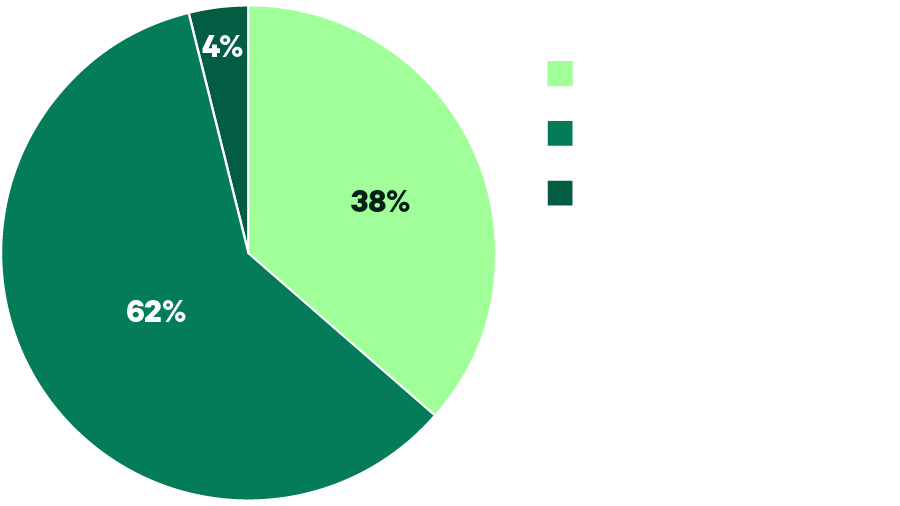

Nearly two-thirds of travel managers are personally concerned about their company’s carbon footprint from business travel, with that figure notably higher in Europe (77 per cent) than in North America (60 per cent).

Are you personally concerned about your company's carbon footprint from travel?

Overall

(235 respondents)

(235 respondents)

Europe

North America

PARTNERING FOR PROGRESS

Travel management companies and booking tool providers are by far and away travel managers’ first stop for helping to deliver on sustainable travel expectations, with 69 per cent of respondents turning to such partners.

Suppliers, third-party consulting companies and specialist carbon calculator tech providers were the next most-used resources, while participation in airlines’ alternative fuel schemes and carbon offsetting projects were less popular.

CARBON QUESTIONS

When it comes to sustainability questions in RFPs, there was little consensus among survey respondents. A quarter of travel managers say they ask for some detail on suppliers’ internal emissions reduction efforts, 16 per cent look for more granular detail, and 13 per cent ask for only basic, check-box type information.

How travel managers and their companies apply that information also varies. Overall, 31 per cent said that if all else is equal, supplier alignment on sustainability influences their supplier selection, while 23 per cent said that, in general, pricing would outweigh suppliers’ sustainability efforts.

In Europe, 21 per cent of travel managers said suppliers’ sustainability efforts significantly factor into partner selection, but only 8 per cent of North American respondents said the same.

SURVEY METHODOLOGY

BTN Europe’s 2024 sustainability survey was conducted in two parts: a survey distributed in North America in April and May and an identical survey distributed in Europe in August and September. The surveys garnered 267 buyer-only responses but not every respondent answered every question.

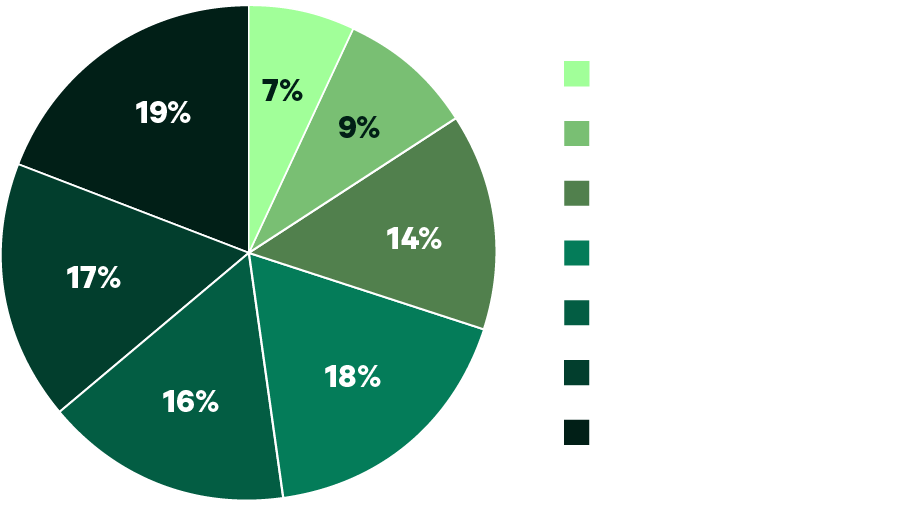

Respondent locations

(267 respondents)

(267 respondents)

Respondents' 2023 business travel spend

(267 respondents)

(267 respondents)